Alfa-Direct reviews 2021 – broker review. An ordinary swindler?

Brokerage service Alfa-Direct is a subsidiary of the Russian banking organization Alfa-Bank. Not so long ago, the brand underwent a reorganization – today the project is called Alfa-Investments; the attention of users is accordingly focused exclusively on investments.

In this review, you have to figure out whether Alfa-Direct is a scam, or is it a decent service that allows you to receive stable passive income.

What is known about the broker Alfa-Direct? History and activity

Alfa-Bank, the managing company Alfa-Investments, has been on the financial services market for 25 years already. It is officially approved by the Central Bank of the Russian Federation, has the appropriate licenses and is one of the ten largest banks in terms of assets. Accordingly, a trader can turn to the regulator in case of conflicts of interest that arise, but this does not mean that there are no problems with the broker at all.

Alfa-Direct broker itself is more focused on serving clients from Russia, which poses serious obstacles for traders from other countries. Users are offered to trade in shares of companies from the Russian Federation, the USA, Europe, and are also allowed to open transactions in the foreign exchange market.

What is offered to traders and investors? Terminals and tools

Alfa-Direct’s official website, frankly speaking, cannot boast of a wide range of tools. Users can trade on the classic QUIK terminal, which is the standard in trading on the stock market. The intermediary provides its own development – the Alpha Investments application, which is available for PC and mobile devices.

In addition, experienced traders who decide to open an account at Alpha Investments can get access to automated robots. The broker does not disclose any specifics regarding the subscription fee and subtleties – but mentions that the connection is free.

Analytics, as the section review of Alfa-Direct showed, is updated extremely irregularly – it cannot be said that the intermediary monitors the relevance of the data. There are no other tools for technical analysis here.

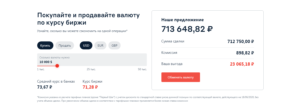

Alfa-Direct tariffs and withdrawal of funds

Registration in Alfa-Investments can be completed in a few minutes – after that, the user needs to go to the replenishment of the deposit. The amount of the minimum deposit is not indicated; the service is presented as “free” and there is no transparency about the broker’s income. There are only 4 tariffs:

Investor – commission for transactions with stocks and currencies is 0.3%, for futures – 0.5% of the exchange fee;

Trader – service costs 200 rubles per month, commissions are on average 0.014% for the exchange market;

Advisor – the owner of this account in Alfa-Direct must pay from 0.5% per annum of the invested amount;

Personal Broker – Free account with commission from 0.14% to 0.5%.

There is also no need to choose from the payment methods provided for implementation from Alfa-Direct. The user makes a transfer either through Alfa-Bank, or through another bank – and nothing else.

Disadvantages of Alfa-Direct and user reviews

Although there are no direct facts indicating that Alfa-Investments is a deception, the broker clearly cannot boast of transparency and a wide selection of assets. Lack of up-to-date analytics, real-time quotes and clear investment terms undermine confidence.

In addition, there are much more negative reviews about Alfa-Direct than positive ones. Users are lured with free promotions and generous bonuses, but they are not allowed to withdraw funds. The support service does not respond to complaints; there are frequent accusations of losing the deposit and constant problems with the application.