ICMarkets reviews – failed lice check?

The attractive image of ICMarkets , founded in 2007, is shaped by the benefits it provides to traders. A more realistic picture can be seen after reading the legal documentation.

ICMarkets is a major Forex CFD operator

According to the company, customers get exactly what they need in cooperation:

- Low spread.

- ICMarkets accounts with and without swaps ( Islamic ).

- Among assets, you can choose commodities, Forex instruments, bonds, stocks, cryptocurrencies , indices, futures.

- Order execution at high speed.

- The latest technologies are used to service client transactions: market depth, automatic closing of transactions based on user templates, spread monitoring. Additionally, ICMarkets has applications for mobile gadgets on the official website.

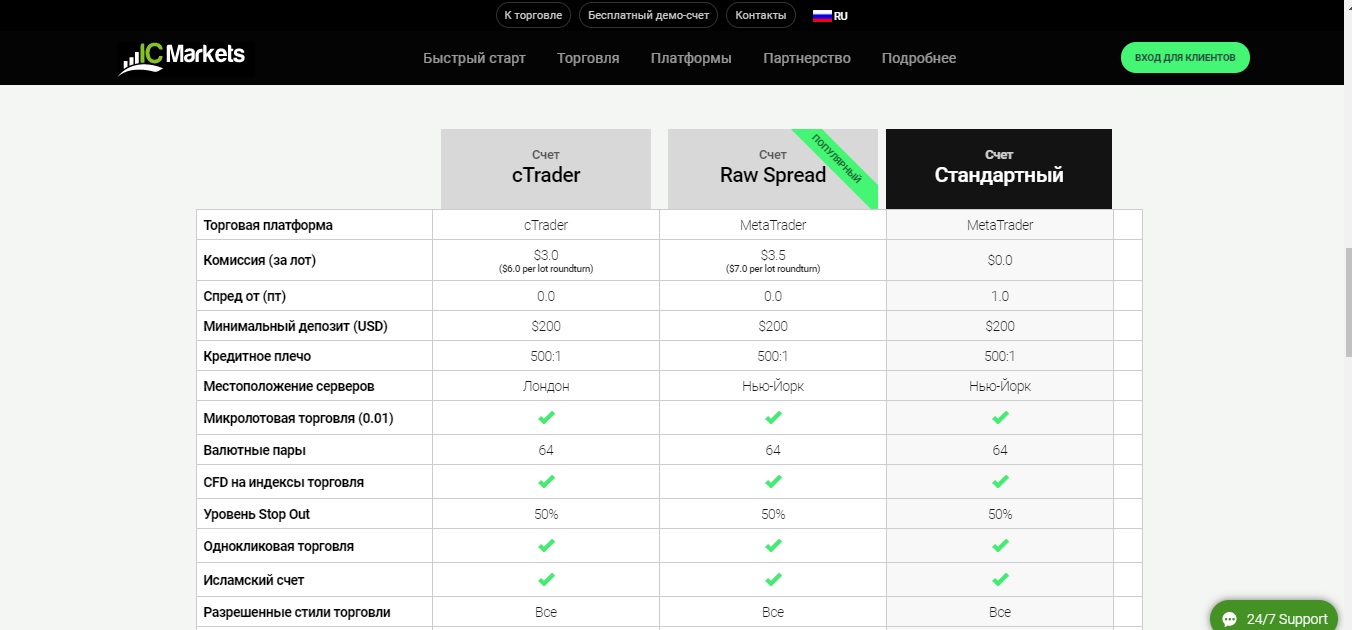

- Trading conditions can be called at least good, because users get convenient transaction volumes (from 0.01 lots) and profitable quotes. Allowed: auto trading, hedging, scalping. Leverage is available up to 1: 500. Deposits are accepted in ten very different currencies. The technology developed by ICMarkets broker arranges orders and sends them to those price providers that offer the best price, tying it to the trading volume.

The support team provides high quality services. Among the leading trading platforms, there are two varieties of MetaTrader, 4 and 5, as well as cTrader. The broker’s honesty and trust in dealing with clients have always been the main values for ICMarkets. Accordingly, the intermediary does not use requotes and does not resort to manipulations. The broker does not set any restrictions.

Official data

The company cooperates with two regulators: ASIC and FSA . Interaction with these supervisory authorities is possible only if the broker complies with all norms and standards. All client money is kept in segregated accounts with the best Australian banks. Users’ money is never redirected to cover the company’s financial needs, which increases the ICMarkets rating quite significantly.

For traders who are not yet confident enough in their abilities, there is the possibility of opening a demo account. Which is very convenient for the trader, and this is reflected in the reviews written about ICMarkets – the account is replenished in 15 different ways, in 10 currencies. Money is credited instantly. There is no commission for the operation.

As financial channels, you can choose: bank cards, payment systems, transfer – bank, Internet option or from a broker’s account. They are listed for entering finance. Additionally, it is allowed to use electronic wallets.

If the goal is to speed up the processing of the request for ICMarkets for withdrawal of funds, then the application must be submitted through your personal account. Types of trading accounts are built according to the True ECN model. You can choose a large number of assets for work. All accounts are suitable for experienced traders and beginners. The difference is only in platforms and commission / spread.

The minimum deposit starts at $ 200. Stop out is triggered at 50%. The target audience of the broker is intraday traders, scalpers, advisor users, trust traders.

Back to section: Online brokers