E*TRADE scam review and testimonials – dubious project?

E*TRADE scam review and testimonials – dubious project?

Today, thousands of brokerage companies offer opportunities to make money on the currency and stock exchanges, and E*TRADE stands out against their background with its history. According to the information, the service has been operating since 1982. However, global recognition and solid experience of the service presence on the market do not always guarantee comfortable cooperation with it. Is it safe to say that E*TRADE’s long history proves its reliability?

What is known about the service? Basic data

| Year of founding | 1982 |

| Management company | Morgan Stanley |

| Jurisdiction | USA |

| Control | SEC |

| Field of activity | Fixed income investment, e-trading in stocks, futures, exchange-traded funds, options |

The American exchange intermediary E*TRADE specializes in both online trading and investments, offering universal tools for active market participants. It should be noted that US citizens are preferred here, so no additional language versions are provided on the site, and customer service is provided exclusively in English. At the moment, the staff consists of over 400 people; A trader can contact the support service at any time and any day – the online chat works 24/7.

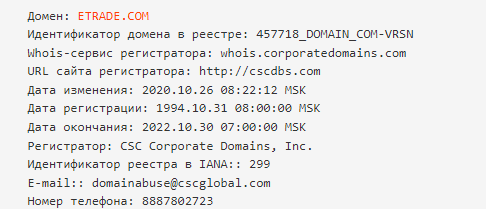

According to the information provided in the WHOIS database, the page’s domain address was registered on October 31, 1994. The domain registration expires this year. At the same time, information about the registrant, including the name of the organization, telephone number, fax, name of the administrator, is not disclosed, which is not very consistent with the statements about the complete transparency of the company. The site was last updated in October 2020 – there have been no innovations on the site over the past two years.

Fraud or a reliable exchange intermediary?

Despite this lack of transparency regarding the platform registration data, there is no doubt that the online broker has indeed been operating for almost 30 years. It is also impossible not to mention that the service has its own Wikipedia page, which has existed since 2005 and has a complete history of the brand. E*TRADE is a well-known and respected broker with branches throughout the United States, providing services to individual and institutional clients.

Official website – what to look for?

When visiting the official website, the user immediately receives an offer to start investing. The design of the platform does not cause complaints – it is simple, modern and unobtrusive. A potential client can already get acquainted with the main offers of the intermediary on the main page, register an account or get an answer in the frequently asked questions section. Some traders note that there is little useful information on the site.

Overview of trading conditions and available accounts

Before going through the registration procedure, the user needs to select one of the three types of accounts offered. The number of accounts is not limited – a trader can choose all three. E*TRADE offers a classic brokerage account for investment and trading, a retirement account for savings and long-term investments, and a bank account for managing your finances. The created account can be individual, joint or even guardian. The general terms of trade are as follows:

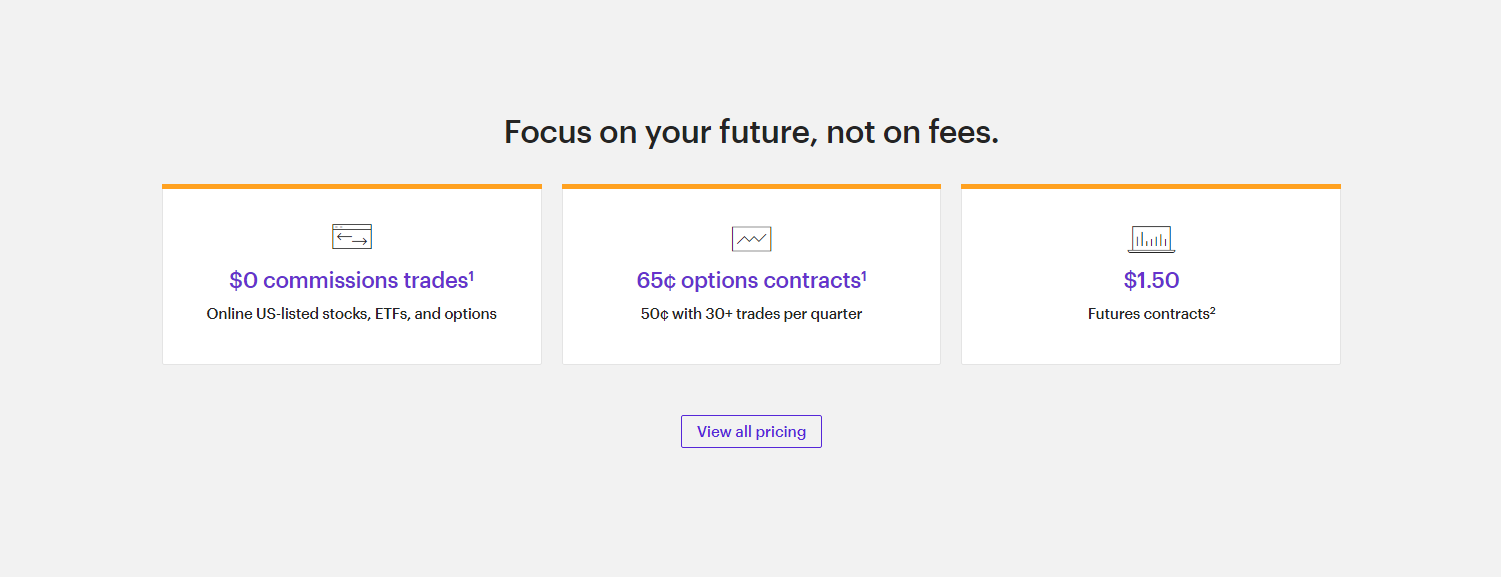

- The minimum amount required is $0, but instruments such as mutual funds require a minimum of $500;

- There is no fee on US and New Issue bonds, while other types of bonds have a fee of $1 or $10-$250 on the online secondary market;

- commissions for trading shares, options and ETFs on US exchanges E*TRADE does not charge;

- The broker offers limited leverage, which cannot exceed 50% of the client’s own funds.

How to deposit and withdraw funds from the site

The service does not provide a demo account, so it will not be possible to test the conditions in advance. The client can replenish the balance of an open account in several ways – using VISA and MasterCard bank cards, a check or through a bank transfer. Withdrawals are made to a bank account. Commissions for input and output are not reported.

In reviews of E*TRADE, users do not mention difficulties with withdrawals, so it can be argued that the broker regularly pays out profits. However, investors note the slowness of support operators and say that traders from other countries who are not US residents cannot count on help.

Trading terminals and other tools

Users can choose from several authoring platforms for working with financial instruments. Instead of the classic MetaTrader 4 software, the broker provides two platforms and mobile applications of its own production:

- E*TRADE Web is a simple and intuitive browser-based platform with access to analytical research, market news, live quotes and educational resources.

- Power E*TRADE is a computer software developed by the E*TRADE broker that offers a wide range of technical analysis tools. Provides access to trading options, futures and stocks.

- Mobile apps for trading and investing on your smartphone or tablet.

Regulation and legal documents of E*TRADE

Of course, the main indicator of the reliability of any financial service is the availability of licenses and regulation by reputable organizations. The firm became a subsidiary of Morgan Stanley only in 2020, and before that it worked as an independent broker. The brand is regulated by the SEC; the intermediary is a member of FINRA, SIPC, NFA, FDIC, which gives him the full right to conclude transactions on US stock exchanges. At the same time, all banking products and services are provided by Morgan Stanley.

Despite such a variety of accounts and offers, as well as a strong legal base, the company has several disadvantages, which are still outweighed by the advantages.

The main strengths are the absence of commissions on shares, ETFs and options of American origin, as well as strong analytics, educational resources and convenient trading applications. The downsides include difficult site navigation, slow support, and no demo account.

Review summary – is it worth trading here?

The intermediary has a flexible entry threshold, a variety of technical instruments and financial services that will suit both active traders and long-term investors. Regulation in the USA and 40 years of work in the field of brokerage services speak of the reliability of this broker, and the reviews of satisfied customers only confirm this.