IPO Limited reviews – bypass the scam project

Broker IPO Limited invites everyone to invest in the initial public offering of the world’s best companies with “legendary market experts”. In case of unforeseen situations, customers are guaranteed insurance for up to $100,000, so they urge not to worry about the funds. At the same time, the IPO Limited service began its activity relatively recently – in 2016. Is it reasonable to trust your finances to such a young platform or is it better to use the services of another broker?

What do you need to know about IPO Limited?

| Year of founding | 2016 |

| Website URL | ipo.limited |

| Jurisdiction | Hong Kong |

| License | missing |

| Contacts | |

| Activity | Investments in stocks and IPOs |

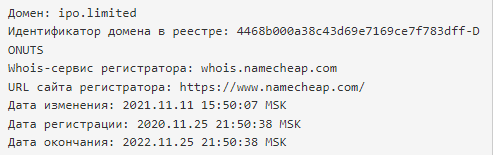

As reported on the organization’s page in the “Company” section, it began its activities in 2016, expanding its activities in the field of legal and administrative support for transactions with shares of initial public offering on the stock exchanges of Hong Kong. Interestingly, no more specific information is provided on the page. Moreover, the statement of work since 2016 is not confirmed by anything, and checking the domain address using the WHOIS database made it possible to establish that the site was launched in November 2020. All data about the registrant is completely hidden; such anonymity and discrepancy of facts do not promote credibility.

Key signs of fraud

The activity of an investment company raises many questions, especially when you consider the number of positive reviews praising its services right and left. They all date from 2021, and there are no comments for previous years when the firm allegedly offered investments. A cheap domain address with purchased hosting for the shortest period of validity and the absence of any documents and reports also hint – one can not even dream of complete transparency.

If we take into account that there are no telephone numbers and contacts, except for a random address of the office space, on the site, then there are even fewer reasons to doubt the Hong Kong registration of the office. In the “Team” tab, where the investor is introduced to the directors and local specialists, there are characters about whom there is absolutely no information on the Internet. Do not trust your funds to dubious individuals who do not have a good reputation in the field of investment and money management.

Overview of the main page and information sections

The official website of IPO Limited is presented in several languages - English, Chinese, Arabic, Spanish and Russian, but the quality of translation in the latter leaves much to be desired.

The visual design looks stereotyped and does not correspond to the image of a solid investment company; it seems that not a penny was invested in the cost of the site. There are no sections with training, analytics, or at least relevant market news. The broker provides only a summary of projects in which, in his opinion, it is worth investing your finances. Some links take the customer back to the home page.

What conditions are offered to traders and investors?

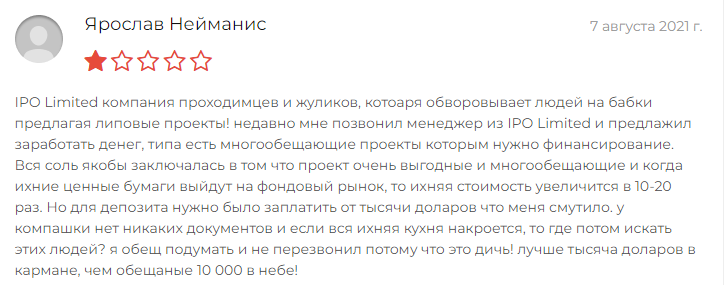

Registering a new account without fail requires providing a phone number, email, and even the name of a consultant – this hints that scammers find their victims themselves on social networks or through cold calling. The office does not publish a detailed description of trading accounts, tariffs or investment conditions, and it provides all the basic information in the FAQ section, which cannot be considered a professional approach. From what is given in the answers to frequently asked questions, we can highlight the following:

- The minimum amount to participate in any IPO is $100;

- Trust management service is available for clients with a capital of $100,000 or more;

- Intermediary IPO Limited also informs that the investor himself determines the amount of investment in the initial public offering, but the actual value of the shares may differ;

- There is no commission for buying shares, and it is not known how the platform earns.

Methods of replenishing and withdrawing profits from your personal account

Another dubious point that scammers pretend to be is the submission of bank cards as an “illegal scheme”, allegedly prohibited by law. Therefore, scammers process all payments exclusively in cryptocurrency and report that in extreme cases, the client can request a withdrawal using SWIFT.

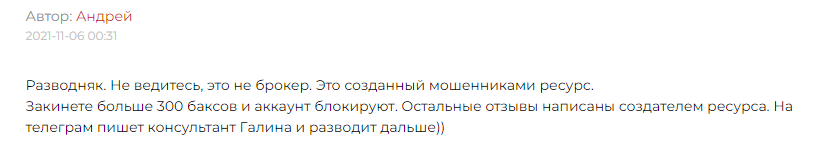

It is important to understand that it is impossible to track and even more so cancel a transaction to a crypto wallet, so the money transferred to the pseudo-broker is guaranteed to remain with him. The fact that the deposit was drained is also evidenced by sharply negative reviews published among the mass of laudatory reviews that were ordered by the crooks themselves. Users do not recommend investing with this intermediary and report that the recommendations of “specialists” lead to losses.

Software and other services

The site does not provide trading terminals or other applications that would allow the trader to independently search and analyze profitable offers and IPO. Instead, it offers a supposedly unique IPIF solution with risk diversification, automatic participation in the best initial offerings, and 100% allocation. In fact, users are advised to invest in “air” and fully trust the decisions and research of dubious experts. Another option is to choose stocks from those presented in the Calendar section and pay the bill.

Documents and licenses of the investment firm IPO Limited

An intermediary with a residence permit in Hong Kong must be licensed by the local regulator in order to have access to the Hong Kong stock markets. However, the hero of the review is not a professional participant in the securities market, and he did not receive any permission to withdraw transactions to the NYSE, NASDAQ, LSE, SSE, SZSE exchanges. Everything becomes clear already in the absence of a standard user agreement, which any company must have.

In connection with all of the above, it is difficult to give at least some advantages of this broker.

But there are a lot of shortcomings:

- lack of legal documents, including licenses, certificates of incorporation, financial statements, agreements and policies;

- Inconsistency between the legend about the start of the IPO Limited and the facts – the site launched operations in 2021;

- the site does not provide contact details and links to instant messengers and social networks;

- there are no detailed and transparent investment conditions – the company also disclaims all responsibility for losses.

Results of the review – why is it better to look for another intermediary?

A cheap site without any specifics, dubious methods of replenishing and withdrawing profits, a lot of customized reviews – the list of shortcomings of this company is endless. It does not look like a solid trustee, and lying about global activities does not add respect to the office.