Saxo Bank: reviews: customer comments

Saxo Bank is a Danish investment bank providing online trading services. The company has been operating on the international market since 1992 and currently serves clients from all over the world. The firm provides advanced opportunities for working in the foreign exchange, stock and other markets. In today’s article, we will tell you on what conditions cooperation takes place and describe several proposed tariffs. Understanding the peculiarities of interaction with the company, the trader will select the best option in accordance with his personal wishes. <! – more ->

Terms of cooperation with Saxo Bank broker

Saxo Bank is a fairly old company that has many years of experience in stock exchanges. The brand has developed its own trading platform for easy and convenient operations in the financial markets. To understand the terms of cooperation and select the optimal broker for personal needs, the speculator should pay attention to the official website.

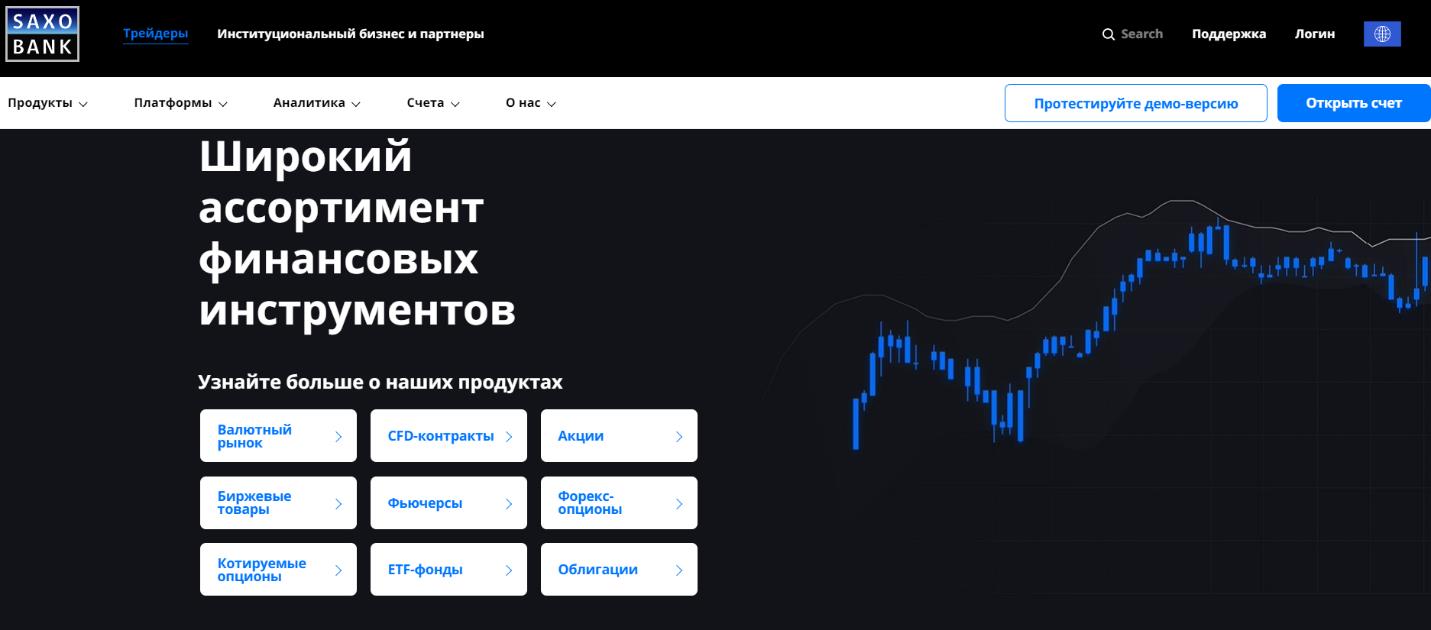

The web resource contains information about the services provided:

- Withdrawals and deposits of funds are carried out via bank transfer, plastic card, securities transaction or electronic wallets. To deposit funds or withdraw earned money, you need to register on the brokerage website and verify your personal account. After that, the trader will be able to use all the declared services.

- A stock trader can work with currency pairs, CFDs, stocks, commodities, futures, options, bonds and funds. Each speculator has his own goals and intentions, in accordance with which it is necessary to build a model of behavior. Taking into account the volatility of the presented instruments, you should select assets that match the working strategy.

- SaxoTraderGO is offered as a trading platform. This program provides access to 35,000 instruments for speculative transactions. The system is powerful and easy to use. It provides a wide range of functionalities and tools for efficient trading. The program can be downloaded both to a computer and a tablet.

- The site contains analytical materials that help to carry out fundamental research of the market floor. After reading the news reports, the speculator will make the right decision about placing trade orders.

- The client can get technical support from the consultants of the company. To clarify the nuances of cooperation, it is recommended to contact your personal manager.

Each stock broker strives to present its services as profitable as possible. At the same time, a trader should be mindful of the high risks and carefully check potential partners. First of all, the dealer needs to pay attention to the comments of past customers. Among the positive aspects, they often note the provision of high-quality analytics and technical support, as well as a convenient trading platform.

In addition, there are negative opinions. Customers complain that the terminal is often malfunctioning, which has a negative impact on the trader’s activity and the potential success of the businessman. Some clients point to withdrawal problems. To avoid delays, the speculator is advised to verify the account in advance and provide the broker with all the necessary documents.

What trading accounts does the broker provide?

Each client is unique, but it is too difficult to select trading conditions for an individual participant. To expand its client base, the broker offers three tariffs that suit different categories of traders:

- Classic – helps to capitalize on their best world market prices. The tariff is based on low start-up prices, good digital services and technical support. The client can get expert advice online.

- Platinum – features tight spreads and low commissions. Quotes are down by up to 30%. The user receives priority customer support in a convenient language.

- VIP – the best trading conditions for wealthy and professional dealers. In addition to the services of the previous tariffs, it is proposed to use direct access to trade experts. The client receives a personal manager to finalize the trading strategy.