WealthSimple Reviews: History of victims divorce WealthSimple.com

WealthSimple is a full financial service that internationally provides simple and affordable assets management tools for traders who have practically no investment experience. Today we will talk about whether true about WealthSimple.com Reviews, or the glory of a 7-year-old broker – purchased.

Brief information about broker

To understand who you have to deal with, we suggest familiarizing yourself with the following table:

| General Director | Michael Katchen |

| Offers Location | Toronto, New York, London |

| official website | wealthSimple.com |

| trading assets | Promotions, stock exchanges and cryptocurrencies |

| trading accounts | 5 types: Invest, Trade, Cash, Crypto and SimpleTax |

| minimum deposit | 0 dollars |

| client base | 1.5 million people |

| the year of the foundation | 2014 (September) |

It is also worth mentioning that this company is the first in Canada that operates without commissions for each individual transaction. Famous personalities, such as Ryan Reynolds or performer Drake, also invest in it.

The company’s website is presented in two languages - English and French. This is not surprising, because it was originally created for Canadian depositors, and later expanded to Britain and the United States. This does not mean that there are any geographical restrictions for users.

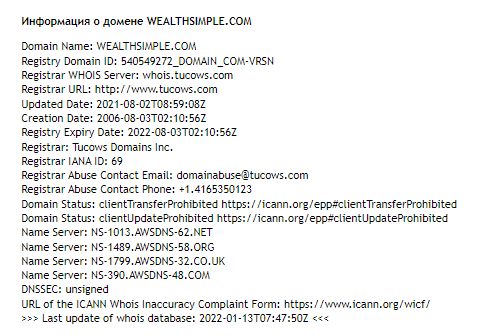

For the purity of the review, let’s check the domain of the official website wealthsimple.com in the Whois service:

As you can see, the site was created in 2006. Despite this, Michael Katchen registered the company as an intermediary only in September 2014 – this is indicated on Wikipedia.

Documentation

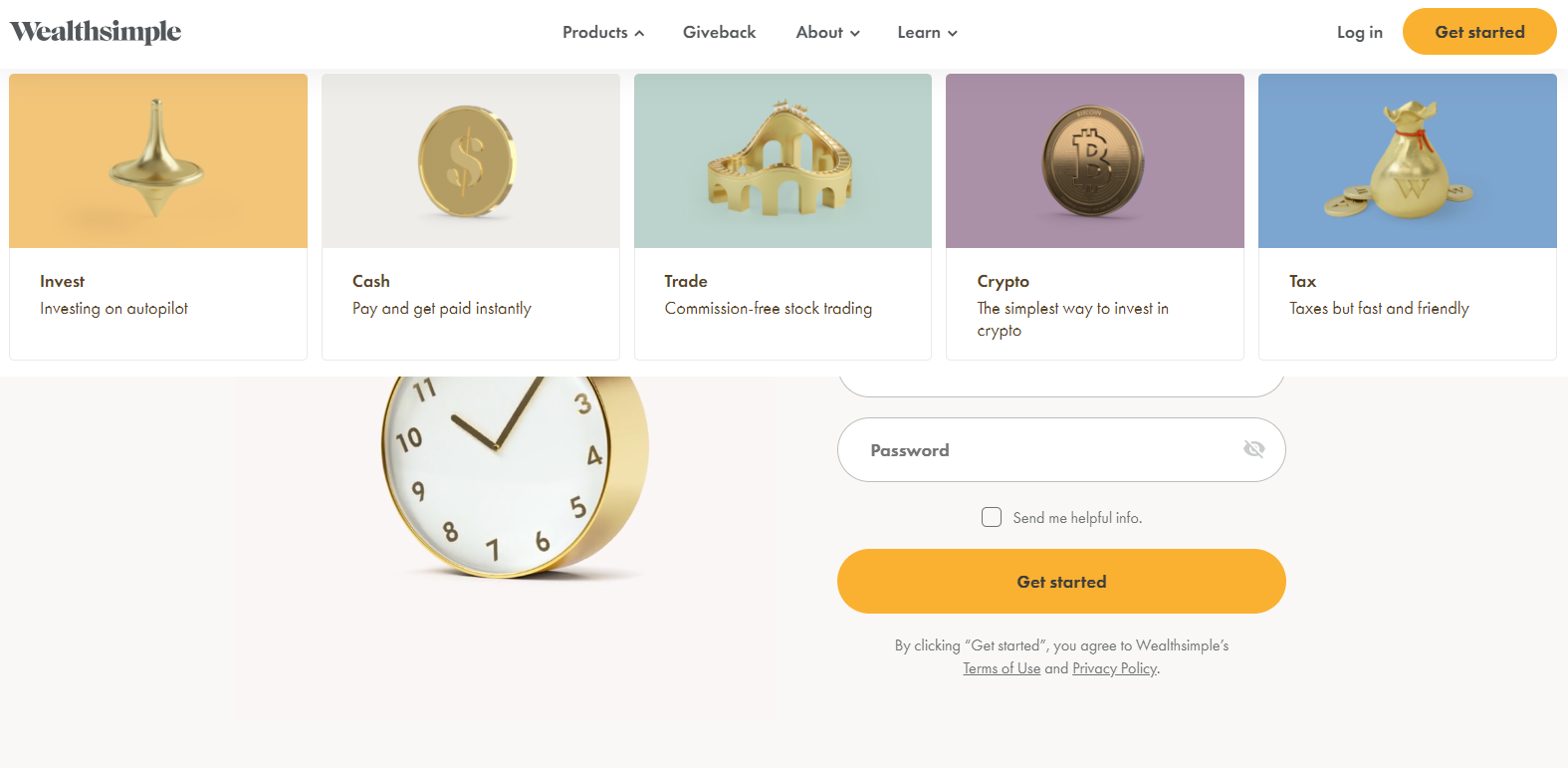

In the footer of the broker’s website, you can find information about which authorities regulate its activities: Canadian ShareOwner Investments and FINTRAC. In addition, the intermediary also has a separate section with all the necessary documents, such as “Terms of Use” and “Disclosure of the trading commission.” We recommend that you familiarize yourself with them in full, because in the financial sector there are increased risks of losses.

Wealthsimple Trading

The first thing that interests every client who has visited the site of a brokerage company is the realization of whether a potential partner has the conditions that he needs. Looking at wealthsimple.com, a Russian-speaking user is likely to get confused and decide to choose another company. But do not rush, let’s decipher all the most important.

How does trading take place?

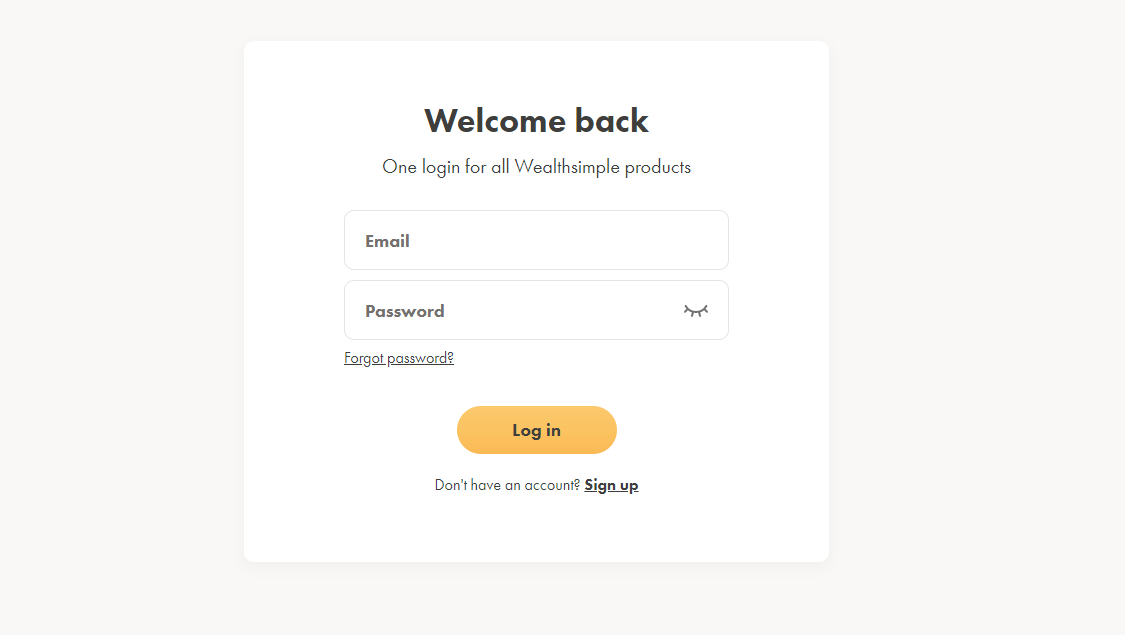

In order to get started, you first need to register on wealthsimple.com. You can register a personal account directly on the site by entering your email and creating a password. After that, you will need to fill out a questionnaire with personal data and pass a short test. Do not worry, the company’s employees will only learn about the trader’s goal in the financial markets and his expectations from trading. The robo-advisor can also ask questions like “What are your monthly expenses?” or “Do you have any debt?”. Answer honestly and without any embellishment – this broker does not interfere with the registration and work of traders.

Further, the investor is given three types of accounts to choose from:

- Basic – a deposit from 0 to 100 thousand dollars (commission 0.5% of capital per year, development of a personal strategy, expert advice, auto deposits, etc.);

- Black – deposit 100-500 thousand dollars (commission 0.4% of capital per year, all the benefits of Basic, collection of tax losses and the most effective tools for trading);

- Generation – $500k deposit (all Black benefits, personal advisory team, individual financial report, turnkey portfolios, etc.)

To get started, you just need to deposit funds – and at the moment you are the owner of a block of shares, cryptocurrencies and other assets formed for your needs.

What can I trade?

As mentioned earlier, wealthsimple.com broker’s list of services includes stocks, exchange-traded funds and cryptocurrencies. Of course, such a list is not able to satisfy the currency pairs trader or the investor who wants to diversify his portfolio of commodities. But the company promises to form everything in the best possible way with maximum benefit.

Who helps clients of wealthsimple.com?

Yes, on the company’s website you can find information that almost everything: from a portfolio to the tips that the robot generates. But there are living people in the Wealthsimple staff. They create personal strategies and help investors who have chosen increased risks.

Contact occurs through a mobile application available on iOS and Android, or through the online interface presented on the site. So far, the company does not have a terminal, because it has not completed testing.

Disadvantages of the broker

Despite the obvious advantages of trading with Wealthsimple, there are also a number of disadvantages that should be considered before starting cooperation:

- all work revolves exclusively around stocks, ETF and cryptocurrencies. Other activities such as trading mutual funds or buying ahead of an IPO are not available;

- in the event that a trader wants to buy shares of companies located in the United States, a currency exchange fee is charged;

- processing of new payments can take up to 3 banking days, which slows down all the activities of depositors;

- quotes on Wealthsimple are shown with a 10-minute delay, so prices may not be entirely correct;

- trading is possible only from a smartphone, because the web version (terminal) is still being tested.

Wealthsimple activity feedback

Kat Dining talks about how, despite the complexity of being a trader, all her work is done easily with the help of Wealthsimple.

But Jacob, on another resource, rates the broker at 3 stars out of 5. True, in the commentary he points out that the company is good, and the service is excellent.

A certain user under the nickname M Sam is also concise in his assessment: a simple interface and a decent profit.

That is, it can be argued that, in general, the reviews on the network for Wealthsimple are positive, which means that working with it does not involve the risk of being deceived.

Does the company have any bonus programs?

Of course, small bonuses encourage traders to choose cooperation with this particular broker. At wealthsimple.com, for each friend you refer, the contributor gets $25, and his friend gets $10 in his account. This small amount is enough even to get started.

Worth collaborating?

In this review, we have considered all the most important aspects that you should pay attention to when choosing an intermediary: from trading accounts to site registration. It became clear that online trading on wealthsimple.com is mutually beneficial and convenient, as real customers of the company say in the reviews. The company has been operating for 7 years, which gives reason to talk about the professionalism and literacy of the approach to its activities due to experience. But the many factors that are created for residents of Britain, Canada and the United States can puzzle the Russian-speaking merchant. This includes both conversion of payments to dollars and English-only support. We advise you to draw your own conclusions before contacting this company.