Webull SCAM broker reviews

Against the backdrop of well-known American exchange intermediaries, Webull stands out not only with a wide range of shares and other financial assets, but also with zero commissions. Users are also offered professional analytical tools and up-to-date quotes. At the same time, it has been working for only 5 years, and such a short period may alert some traders. Is Webull trustworthy, or is it better to turn to brokers who have been serving investors for decades?

Webull Key Features

| Year of founding | 2017 |

| Jurisdictions | USA, China, Malaysia, Thailand |

| Regulators | SEC, FINRA |

| Customer Support | 24/7 |

| Field of activity | Investing and trading in stocks, cryptocurrencies, currencies, funds ETF |

The Webull brand is owned by the eponymous financial holding Webull Financial LLC and has been serving individual and institutional investors since 2017. Clearing services are provided by Apex Clearing Corp. The main audience of the broker are experienced market participants – it will not be easy for beginners to get used to the platform. The activity of an intermediary is allowed in all US states, in China, Thailand and some other Asian countries.

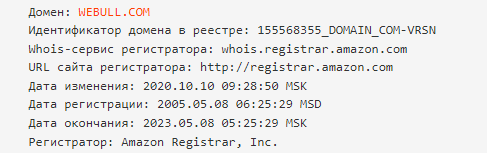

The domain of the official site is quite old – it was registered back in 2005, but the archives of the WHOIS database contain page snapshots for 2001 as well. However, the hero of the review “settled” here only in 2017, as evidenced by the domain history, and since then he has been constantly improving and expanding the existing functionality. The last update was made in October 2020 and the domain registration expires in 2023.

Trust or verify – is Webull a scammer?

Although this brand appeared on the financial services market relatively recently, you should not rush to conclusions and immediately classify it as “unreliable”. Registration on the largest US stock exchanges makes the service a full-fledged trading participant and assures investors that their transactions are guaranteed to get to the exchange and are executed according to all standards.

Investors who have encountered a conflict of interest and suffered losses can apply to a compensation fund, but in general there are no statements about non-fulfillment of agreements.

Official page and section navigation

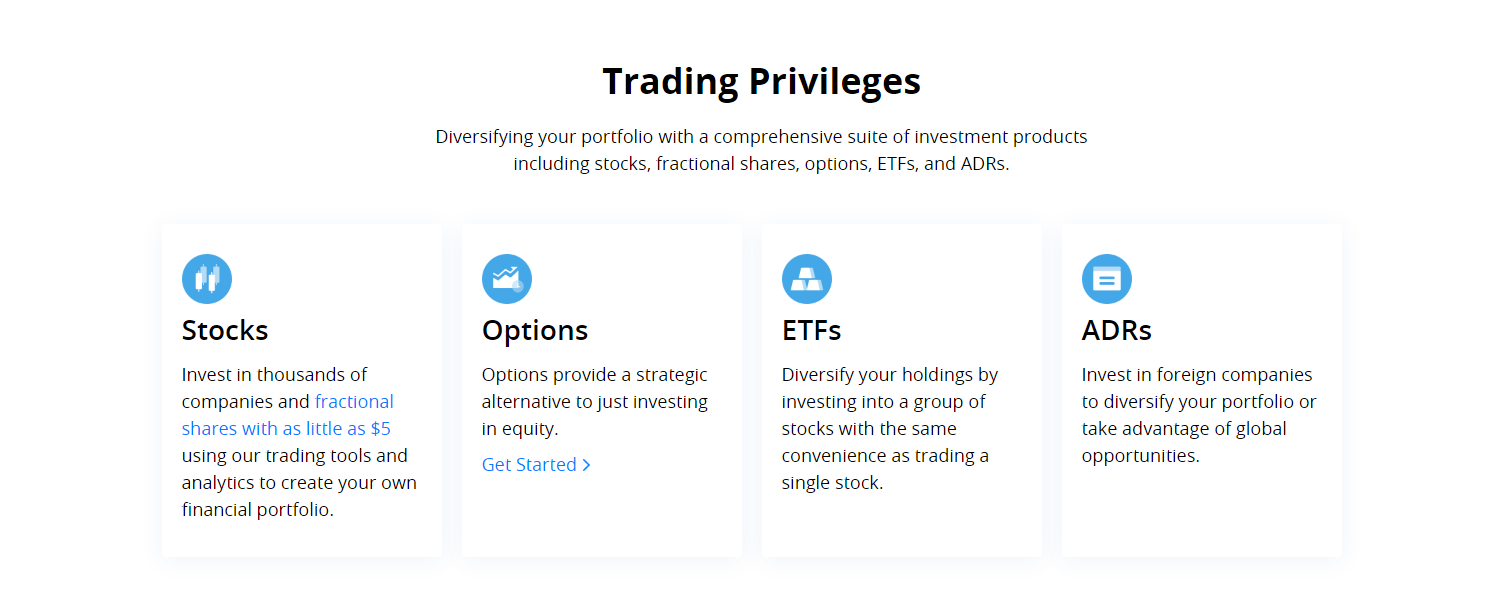

The design of the site’s main page makes a good impression, but the lack of additional language versions other than English and Chinese can be a serious obstacle for traders from other countries. The user can immediately familiarize himself with the trading privileges that he receives after registering an account. Navigation on the official site is not the most convenient – there are no sections with analytics, educational materials or other tools for market research. To find the information you need, it is better to use the section with frequently asked questions.

What trading and investment conditions does the broker offer? Invoice Overview

With regard to trading conditions, the company tries to maintain full transparency. For example, it warns of possible fees from regulators and exchanges, which are passed on to the client as a pass-through transaction. Such deductions are not part of the broker’s profit, and their size varies from the total volume of the transaction or the number of contracts.

These rules apply to transactions in stocks, options and ETFs, and generally involve payments for clearing or trading activity in general.

It has already been mentioned above that the services are mainly provided to experienced traders, although a demo account is available on the site. And that’s why:

- although there is no minimum deposit, you need to have at least $2,000 on your account to work with margin – if the balance is less than this amount, the position will be automatically liquidated;

- Webull broker charges high fees for deposits and withdrawals – wire transfer fees range up to $45.

- access to NASDAQ statistics and up-to-date quotes is provided by a paid subscription.

Depositing and withdrawing funds from the balance

Operations with the input and output of funds are possible through a bank transfer, however, users note the presence of connecting cryptocurrency wallets. The commission for replenishing the balance for US residents is $8, for traders from other countries – $25, and the withdrawal of profits is subject to an additional fee of $45. Among the reviews about Webull, there are no accusations of draining the deposit; users are generally satisfied with the service, but they warn that there is no operational support here.

Trading platform and analytics

Sections with analytics and training, as already mentioned, are not provided on the site. In return, the broker offers functionality embedded in trading terminals, which includes NASDAQ quotes, technical indicators, and up-to-date analytical tools. Three solutions are available for making money on stocks, funds, currency pairs and cryptocurrencies: software for computers, the Webull App mobile application and a browser platform that works on any device.

Overview of legal documents and licenses – how are investors protected?

In 2018, a year after its founding, the intermediary received licenses from the SEC and FINRA. At the moment he is a member of SIPC and the largest stock markets NYSE, NASDAQ and CBOE.

Clients can have peace of mind with their funds as SIPC membership provides conflict of interest compensation of up to $500,000. In addition, the broker’s obvious benefits include a flexible, customizable trading platform, an affiliate program and a demo account. To the “fly in the ointment” users include the following aspects:

- There is no online chat or other ways to quickly contact the support service on the Webull platform – only mail, phone and social media accounts appear in contacts;

- High commissions, high leverage requirements and no tutorial section – these conditions are not suitable for beginners and traders with a small deposit;

- Small choice of language versions – service is provided only in English and Chinese.

Conclusion – what can be said about the Webull broker?

Although the service has just started its work, the regulation in the USA and the status of a professional participant in the securities market clearly indicate that it is seriously aimed at long-term cooperation with large investors. But before opening a real account on the site, it is better to test the functionality of the demo account and carefully read the user agreement to avoid misunderstandings.